Alright, let’s talk about the graveyard.

Not the spooky one with fog and skeletons.

The Amazon product graveyard—where listings launch with hope, spike for a few weeks, and then quietly flatline after month three. No sales. No traffic. Just storage fees and regret.

Most products don’t fail because the seller was lazy. They fail because the research products was shallow. A few tools, a couple screenshots, a dopamine hit from seeing “high demand,” and boom—order placed.

That’s not research. That’s gambling with better UI.

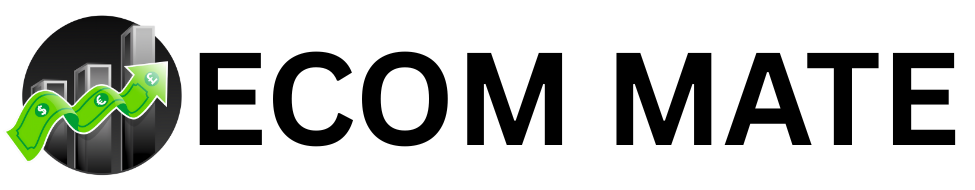

This post breaks down how we research products for private label that don’t die after 3 months. Not trendy, not lucky, not dependent on one algorithm sneeze. Built to survive saturation, copycats, and market mood swings.

No fluff. No guru nonsense. Written for humans who want real businesses.

The Core Problem: Most Product Research Is Time-Blind

Here’s the uncomfortable truth:

Most sellers research products like they exist in a vacuum—right now, in this exact moment.

They look at:

- Current sales volume

- Current competition

- Current keyword demand

What they don’t look at:

- Where this product came from

- Why it’s selling

- How it behaves over time

- What happens when five clones enter the market

A product that looks amazing today can be structurally doomed tomorrow.

Our entire research philosophy revolves around one question:

“Will this product still make sense six to twelve months from now?”

If the answer isn’t a confident yes, it doesn’t move forward. Period.

Step 1: We Hunt for Boring Demand (On Purpose)

Exciting products are usually bad products.

Trendy colors. Viral TikTok items. “Just discovered” niches. Seasonal spikes pretending to be evergreen demand. These are sugar highs. They feel amazing and then crash hard.

We deliberately look for boring demand:

- Products people need, not want

- Products that solve recurring problems

- Products bought out of habit, not excitement

Boring demand has three magical properties:

- It doesn’t disappear overnight

- It doesn’t rely on influencers

- It attracts fewer reckless sellers

If a product feels flashy, we get suspicious. If it feels dull but useful, we lean in.

Longevity lives in boredom.

Step 2: We Analyze Demand Over Time, Not Just Volume

High monthly sales mean nothing without context.

A product doing 3,000 units a month could be:

- A stable workhorse

- A seasonal item peaking

- A trend already dying

So instead of asking “How much is it selling?” we ask:

- Has demand been stable for at least 12–24 months?

- Are there predictable dips and recoveries?

- Does the product survive off-season periods?

We zoom out. Way out.

If a product’s chart looks like a heart monitor during a panic attack, it’s out.

If it looks boring, flat, and reliable? Now we’re listening.

Step 3: We Separate Real Competition from Fake Competition

This is where most sellers completely misread the room.

They see:

- Lots of listings

- High review counts

- Similar-looking products

And they assume “too competitive.”

Wrong question.

We ask:

- Are competitors brands, or just sellers?

- Are listings optimized emotionally or just keyword-stuffed?

- Is the top 10 defensible, or lazy and outdated?

A saturated niche with weak branding is often easier than a “low competition” niche with aggressive brand loyalty.

We look for signs of laziness:

- Generic images

- No brand story

- No variation strategy

- Identical packaging everywhere

If everyone looks the same, differentiation becomes cheaper—and survival becomes realistic.

Step 4: We Look for Structural Weaknesses (Before We Improve Anything)

Here’s a subtle but critical point.

We don’t ask:

“How can we make this product better?”

We ask:

“Why does this product currently exist in this form?”

Because every weakness tells a story:

- Supplier limitations

- Seller shortcuts

- Cost-cutting decisions

- Knowledge gaps

Examples of structural weaknesses:

- Poor packaging because sellers race to the lowest price

- Bad instructions because no one bothered

- Fragile materials because returns haven’t caught up yet

- Ugly branding because the product still sells despite it

If a product survives with obvious flaws, it’s not fragile. It’s resilient.

Fixing real weaknesses extends lifespan. Cosmetic changes don’t.

Step 5: We Validate Repurchase Logic (The Silent Killer)

This step kills more product ideas than any other.

We ask:

- Is this a one-time novelty purchase?

- Or does it naturally lead to repeat buying?

Products that die after 3 months often have one thing in common:

They rely entirely on new customers.

That’s exhausting. And expensive.

We prefer products with:

- Consumable elements

- Replacement cycles

- Natural add-ons

- Usage wear and tear

If a customer buys once and never needs it again, the product must:

- Have massive demand, or

- Be expandable into a product line

If neither is true, it’s a ticking clock.

Step 6: We Stress-Test Copycats Before They Exist

Assume success. Now assume clones.

Because they’re coming.

So we ask:

- How easy is this to copy exactly?

- What happens when five cheaper versions appear?

- Does branding matter here, or only price?

If the only moat is price, the product is already dead. It just doesn’t know it yet.

We favor products where:

- Trust matters

- Instructions matter

- Perceived quality matters

- Brand memory influences choice

These products don’t collapse the moment competition increases. They bend.

Step 7: We Map Expansion Paths Before Launch

This is where short-term sellers and long-term builders split.

Before launch, we already know:

- What the second product could be

- What variations make sense

- How the brand could logically grow

If a product is a dead-end, it’s risky.

If it’s a gateway, it’s powerful.

Even if the first product performs “okay,” the brand can compound. That’s how products survive beyond the honeymoon phase.

Step 8: We Sanity-Check with Human Logic

No tools. No charts. Just thinking.

We ask uncomfortable questions:

- Would we buy this at this price?

- Would we trust this brand?

- Would we recommend it to someone we like?

- Does this feel like a real product, or a spreadsheet product?

If something only works on paper, it won’t work in the real world.

People buy emotionally, justify logically, and complain loudly.

Ignoring that reality is how products die quietly.

Why This Approach Works (And Why It’s Slower)

Yes, this method takes longer.

Yes, it rejects more products than it approves.

Yes, it’s less exciting than chasing “hot niches.”

But here’s the tradeoff:

- Fewer launches

- Fewer disasters

- Fewer desperate pivots

- More stable sales curves

- Products that age instead of decay

We’re not trying to win launch week.

We’re trying to still be selling when everyone else has moved on.

Final Thought: Longevity Is Designed, Not Discovered

Products don’t “randomly” die after 3 months.

They’re designed to.

Designed by:

- Short-term thinking

- Tool addiction

- Trend-chasing

- Copy-paste strategies

Surviving products are intentional. They’re researched with patience, skepticism, and a deep respect for how markets actually behave.

The market rewards builders who think in timelines, not screenshots.

And that’s the real edge—quiet, boring, and incredibly profitable over time.

To wrap it up: product research is only half the equation. Execution is where most brands either compound… or collapse. If you want this kind of long-term, timeline-aware product research done for you, not guessed at with tools and hope, you can explore our full Amazon Private Label Services on the main service page. That’s where we break down how we turn research into real, defensible ecommerce brands—not short-lived listings that burn out after a season.