Amazon product research is where private label dreams either get funded… or quietly buried.

Everyone thinks they’re doing research. They install a tool, see green numbers, nod solemnly, and whisper: “This is the one.”

Six months later, they’re wondering why their garage looks like a small warehouse liquidation.

The problem isn’t effort.

The problem is believing the wrong metrics and ignoring the boring, inconvenient ones that actually decide whether a product lives or dies.

Let’s separate signal from noise.

The Core Problem With Amazon Product Research

Most sellers are taught to hunt for numbers that look good, not numbers that tell the truth.

Revenue looks impressive.

Search volume feels scientific.

Low competition sounds comforting.

But Amazon isn’t a spreadsheet game. It’s a behavioral marketplace where humans click, hesitate, compare, doubt, and only then buy.

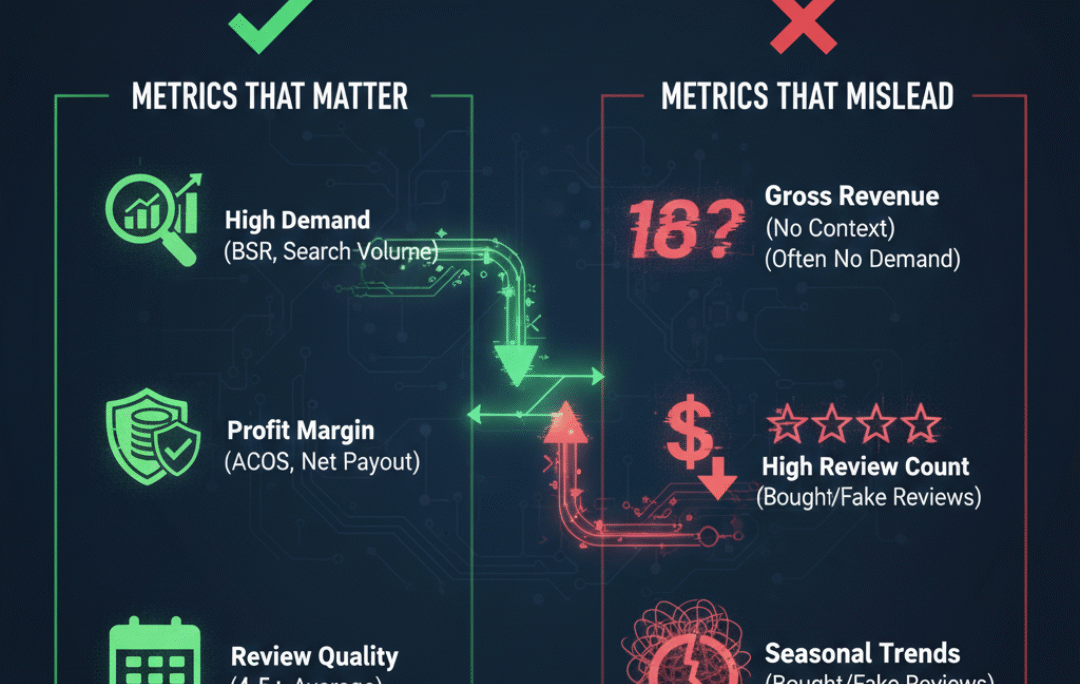

Metrics that matter explain why people buy.

Metrics that mislead just explain why a tool wants you to feel confident.

Metrics That Actually Matter (The Grown-Up Stuff)

1. Demand Consistency (Not Just Demand)

High demand for two weeks means nothing.

High demand for 12 months means everything.

A product selling 3,000 units this month but 400 units for the rest of the year is a seasonal trap, not an opportunity.

What you want:

- Stable sales across multiple months

- Minimal violent spikes

- No sudden “dead zones” unless seasonality is intentional

Consistency tells you something crucial:

People don’t just want the product. They keep wanting it.

This is how brands are built. Not by catching fireworks, but by owning campfires.

2. Revenue Distribution (Who’s Actually Winning?)

Here’s a sneaky one most sellers skip.

Look at the top 10 listings.

Then ask: Who is making the money?

If:

- One seller owns 70% of revenue → danger

- Top 3 dominate everything → uphill battle

- Revenue is spread across 6–8 sellers → healthy market

A market where many sellers survive means:

- Customers aren’t blindly loyal

- Branding and positioning can still matter

- You can enter without burning cash

Amazon rewards choice, not monopolies—unless the monopoly already exists.

3. Review Velocity (Not Just Review Count)

A listing with 5,000 reviews looks scary.

A listing gaining 300 reviews every month is terrifying.

Total reviews tell you history.

Review velocity tells you momentum.

High review velocity usually means:

- Aggressive PPC

- Strong conversion rate

- A brand that’s actively scaling

Those sellers aren’t sleeping.

They’re optimizing.

A lower total review count with slow velocity can actually be easier to beat with better branding, content, and positioning.

4. Listing Quality Gaps (Your Real Opportunity)

This is where experienced sellers get excited and beginners get bored.

Metrics won’t show you:

- Ugly images

- Confusing titles

- Weak A+ content

- Copy that explains nothing

But customers feel these things immediately.

If you see:

- Generic photos

- Bullet points stuffed with keywords

- No brand story

- No emotional hook

That’s not competition. That’s an opening.

Amazon rewards clarity and trust more than keyword density.

Always has. Still does.

5. Price Elasticity (Can the Market Breathe?)

Ask yourself a dangerous question:

Can I raise or lower price without killing sales?

If every product sits between $19.99–$20.99, the market is brittle.

If prices range from $18 to $35 and still sell, the market has flexibility.

Flexible pricing means:

- Branding matters

- Value perception exists

- You’re not forced into a race to the bottom

Margins survive where prices can move.

Metrics That Mislead (The Shiny Traps)

Now let’s talk about the stuff that gets people wrecked.

1. Search Volume (Out of Context)

Search volume sounds scientific. It feels precise.

But search volume without buyer intent is just curiosity count.

“Resistance bands” has massive volume.

So does “gift ideas for men.”

That doesn’t mean buyers are ready to commit money.

High-volume keywords often attract:

- Browsers

- Comparison shoppers

- Deal hunters

- People “just looking”

Sales come from intent, not curiosity.

2. “Low Competition” Scores

Whenever a tool tells you competition is “low,” ask:

Low compared to what?

Most competition scores:

- Ignore brand loyalty

- Ignore off-Amazon traffic

- Ignore PPC budgets

- Ignore listing quality

A market with bad listings but high demand might score “medium” — and be gold.

A market with polished brands might score “low” — and eat you alive.

Competition isn’t a number.

It’s behavior plus resources.

3. Revenue Screenshots (The Instagram Metric)

Seeing “$300K/month” triggers dopamine.

It also triggers terrible decisions.

High revenue listings often come with:

- Razor-thin margins

- Massive ad spend

- Inventory risk

- Constant optimization pressure

Revenue without profit context is theater.

You don’t pay suppliers with screenshots.

4. BSR Obsession

Best Seller Rank is useful… but only relatively.

A #3,000 BSR in Kitchen doesn’t equal a #3,000 BSR in Sports.

BSR changes fast.

Sometimes hourly.

It’s a symptom, not a cause.

Treat it like a heartbeat monitor, not a diagnosis.

5. Tool “Opportunity Scores”

These scores are confidence machines, not truth machines.

They compress complex human behavior into a single number because:

- Humans love simplicity

- Fear hates nuance

- Decisions feel easier that way

But Amazon success lives in nuance.

Use tools to gather data.

Never use them to make decisions alone.

What Actually Wins on Amazon (The Uncomfortable Truth)

Winning products usually have:

- Decent demand (not insane)

- Imperfect competition

- Clear customer pain points

- Space for branding

- Room for price positioning

They rarely look sexy in tools.

They look boring.

Predictable.

Almost disappointing.

Until they make money consistently.

The Missing Metric Nobody Talks About: Buyer Psychology

Read reviews.

Actually read them.

Not for star ratings — for language.

Look for:

- Repeated complaints

- Confusion about usage

- Mentions of poor quality

- Emotional frustration

- Unmet expectations

Every complaint is a design brief.

Every frustration is a branding opportunity.

Amazon is a giant feedback engine pretending to be a marketplace.

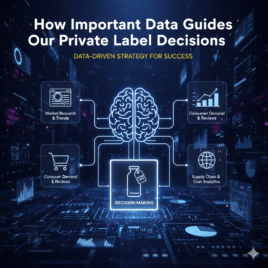

How We Approach Product Research (In Plain English)

We don’t hunt “winning products.”

We hunt fixable markets.

Markets where:

- Demand exists

- Sellers are lazy or generic

- Branding is weak

- Customers are annoyed

- Differentiation is possible without reinventing physics

Metrics guide us.

Human judgment decides.

That balance is what keeps products alive past the launch phase.

Final Thought: Numbers Don’t Build Brands

Metrics help you avoid stupidity.

They don’t create success.

Success comes from:

- Understanding customers

- Solving real problems

- Presenting value clearly

- Building trust fast

Amazon product research isn’t about finding perfection.

It’s about finding opportunity you can execute on better than others.

And that’s something no tool can calculate for you.

Because at the end of the day, Amazon isn’t buying your product.

People are.

And people are gloriously, frustratingly, wonderfully human.

If all of this feels like a lot to juggle alone, that’s because it is. Product research isn’t about finding “magic numbers” — it’s about experience, judgment, and knowing which signals to trust and which to ignore. That’s exactly what we do for brands every day. If you want your Amazon product research handled strategically, not mechanically, you can explore our Amazon Private Label services on our main page and see how we turn data into decisions that actually make money.