Amazon Private Label is often sold as a lottery ticket.

“Find a product, slap a logo on it, launch, retire early.”

Reality check: that version dies fast.

Real private label is closer to brand-building with math involved. It’s part research lab, part psychology experiment, part logistics marathon. When it works, it works beautifully. When it’s rushed, Amazon eats you alive.

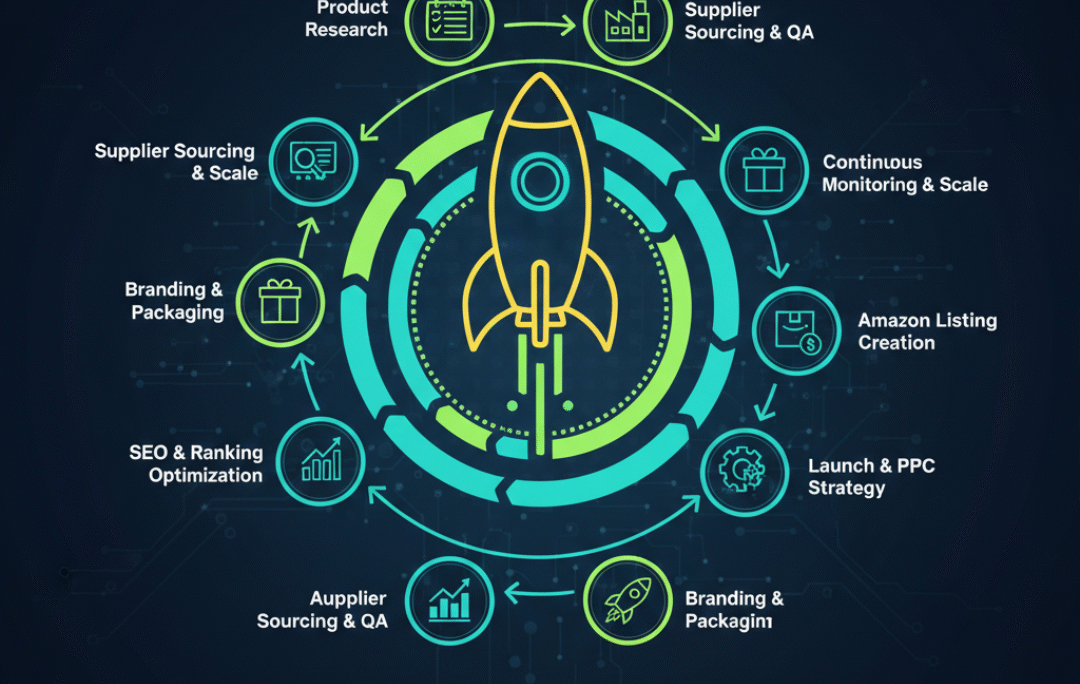

Here’s exactly how we approach it—step by step, without skipping the boring (but crucial) parts.

Step 1: Market First, Product Second

Most beginners do this backwards. They “fall in love” with a product idea, then try to force it onto Amazon like a square peg into a very competitive hole.

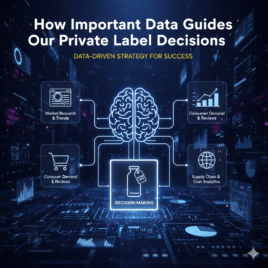

We start with the market.

That means answering uncomfortable questions early:

- Are people already buying this consistently?

- Is demand stable, or is it a TikTok trend with a half-life of three weeks?

- Are buyers price-sensitive or brand-sensitive?

- Is the niche dominated by actual brands—or just generic sellers racing to the bottom?

We look at:

- Sales velocity, not just monthly revenue screenshots

- Review distribution (are the top listings untouchable or vulnerable?)

- Price bands and margins after all Amazon fees

- Seasonality patterns (some products are liars)

If the market doesn’t make sense, we walk away.

There’s no emotional attachment here. Amazon punishes optimism.

Step 2: Product Validation (Before a Single Dollar Is Spent)

This is where we separate “possible” from “profitable.”

A product can sell well and still be a terrible private label idea. Why?

- Fragile items bleed money in returns

- Complex items invite customer complaints

- Oversized items quietly murder margins

- Restricted categories create account risk

We validate against:

- Amazon policies (today’s allowed item can be tomorrow’s suspension)

- Logistics practicality

- Quality control complexity

- Differentiation potential (this matters later)

If we can’t see a clear path to improving or positioning the product, we don’t touch it.

Private label is not about copying what already exists. It’s about doing one or two things noticeably better.

Step 3: Competitive Intelligence (Not Guesswork)

At this stage, we stalk the competition. Respectfully. Analytically. Thoroughly.

We break down:

- Top listings’ images (what they emphasize vs hide)

- Their reviews (especially 2–4 star reviews—pure gold)

- Their branding tone (cheap, premium, confused, or asleep)

- Their A+ content and storefronts

This tells us:

- What customers wish these products did better

- What problems are still unsolved

- How much branding actually matters in this niche

Amazon reviews are unpaid focus groups. Ignoring them is like ignoring free therapy notes about your future mistakes.

Step 4: Supplier Sourcing & Quality Control Planning

Suppliers are not just factories. They are long-term relationships—or long-term headaches.

We don’t chase the cheapest quote. Ever.

We look for:

- Consistent quality history

- Clear communication (this matters more than people admit)

- Willingness to customize without drama

- Realistic MOQs that allow testing and scaling

Samples are non-negotiable.

And we don’t just “check if it looks fine.”

We test:

- Packaging durability

- Functionality over time

- Accuracy of claims

- Variations between samples (consistency tells you a lot)

If something feels off here, it usually explodes later during scaling. This step saves thousands by being slow on purpose.

Step 5: Brand Strategy (Before Design Happens)

Branding is not a logo. It’s a decision system.

Before a single design is made, we define:

- Who this product is for (and who it’s not)

- Whether the brand leans premium, practical, or value-driven

- What emotion the buyer should feel when they open the box

- How this product fits into a future product line

Amazon is full of one-product orphans. We avoid that.

Every private label product should feel like:

“This is product #1 of something bigger.”

That mindset changes everything—from packaging to naming to copywriting.

Step 6: Visual Identity & Packaging Design

Now design enters the room—but with constraints and intent.

Amazon is a visual battlefield. People don’t read first. They scan.

We design:

- Packaging that communicates value instantly

- Logos that survive small mobile screens

- Color systems that stand out without screaming

- Inserts that support the brand (not beg for reviews like it’s 2018)

Good design doesn’t just look nice.

It reduces returns, increases perceived value, and raises conversion rates without lowering prices.

Cheap-looking brands compete on price forever. That’s a miserable way to live.

Step 7: Listing Optimization (Human First, Algorithm Second)

Yes, keywords matter.

No, keyword stuffing does not magically convert humans into buyers.

Our listing approach balances:

- Search intent (what people actually want)

- Clarity (what problem this solves)

- Proof (why this version is better)

- Structure (mobile-friendly, skimmable, logical)

This includes:

- Title optimization without turning it into a word salad

- Bullet points that answer objections

- Descriptions that sound like a human wrote them

- A+ content that educates, not decorates

The goal is simple:

Make the buyer feel confident, not confused.

Amazon rewards listings that convert. Conversion is king.

Step 8: Launch Strategy (Controlled, Not Chaotic)

Launching isn’t about “hacking” Amazon. It’s about feeding it clean data.

We plan:

- Initial pricing strategy (not permanent discounts)

- PPC structure from day one

- Inventory pacing to avoid stockouts or dead stock

- Early feedback loops from real buyers

We do not chase fake urgency.

We don’t manipulate reviews.

We don’t play games that risk accounts.

A clean launch builds momentum that compounds. A dirty launch builds stress.

Step 9: Post-Launch Optimization (Where Most Sellers Stop Caring)

The launch isn’t the finish line. It’s the beginning.

Post-launch, we analyze:

- Click-through rate vs conversion rate

- PPC performance by keyword intent

- Review patterns and emerging objections

- Return reasons (these are brutally honest)

Based on data, we refine:

- Images

- Copy

- Pricing

- Ad structure

- Sometimes the product itself

Amazon is dynamic. Static sellers get buried.

Step 10: Scaling Like a Brand, Not a Gambler

Once the product stabilizes, we shift gears.

Scaling is not “spend more on ads and pray.”

It’s about:

- Expanding keyword coverage strategically

- Improving margins through supplier renegotiation

- Planning complementary products

- Strengthening brand presence beyond a single SKU

At this stage, the goal changes:

From “making sales”

To “building an asset”

An Amazon private label brand done right can be sold. That’s the endgame most sellers never plan for—but should.

Why This Process Works (And Why It’s Boring on Purpose)

There’s nothing flashy here. No shortcuts. No viral tricks.

That’s intentional.

Amazon private label rewards:

- Consistency

- Quality

- Buyer satisfaction

- Brands that think long-term

This process avoids the two biggest killers of private label businesses:

- Rushing decisions

- Treating Amazon like a casino

If you respect the system, it quietly rewards you.

Final Thought on our Private Label Expertise

Amazon Private Label isn’t dead.

Bad execution is.

The opportunity is still there—for people willing to slow down, think like brand builders, and use data instead of hope.

That’s the difference between launching a product…

And building something that actually lasts.

If this process feels structured, deliberate, and very different from the “just launch something” advice floating around online, that’s not an accident. This is exactly how we handle Amazon Private Label projects for clients who want clarity, control, and long-term growth—not guesses and burnout. If you want to see how this process applies to your situation, you can explore our Amazon Private Label service here and get a clear picture of what working with us actually looks like.