There’s a romantic myth floating around ecommerce that great products are born from gut instinct. A founder “just knows” what will sell. They feel the market. They sense the trend. They follow vibes.

That’s adorable.

It’s also how people lose $15,000 on 800 units of silicone garlic peelers.

Private label isn’t gambling. It’s probability management. And probability is ruled by data.

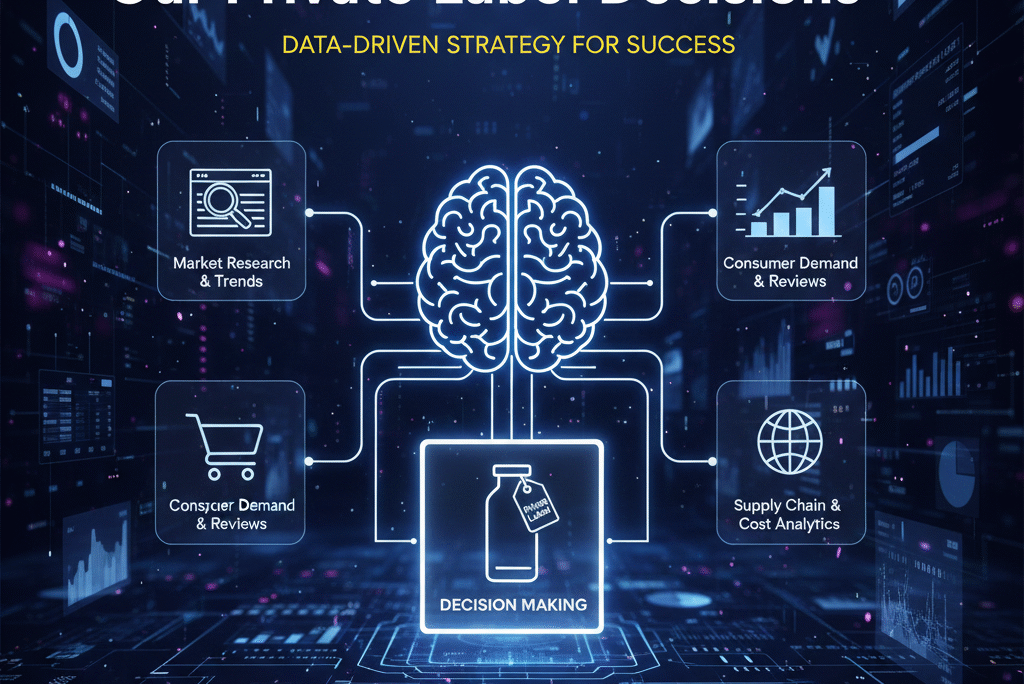

When we make such decisions — whether it’s for Amazon, eBay, or Etsy — we’re not guessing what might work. We’re stacking evidence until the odds tilt in our favor. Not perfectly. Not magically. But measurably.

Let’s break down how that actually works in the real world.

Step One: We Don’t Start With Products. We Start With Markets.

Most beginners search for “winning products.” That’s backwards.

Products sit inside markets. Markets determine demand stability, price elasticity (how much price affects buying behavior), and competitive pressure. If the market is fragile, the product doesn’t matter.

So the first question isn’t:

“Is this product trending?”

It’s:

“Is this market durable?”

We look for:

- Consistent demand over 12+ months

- Non-seasonal or predictable seasonal patterns

- Clear customer pain points

- Room for brand differentiation

If demand looks like a roller coaster built by caffeine addicts, we move on. Trend spikes can be profitable — but they are short-term plays, not brand-building foundations.

Private label is long-term. We’re building assets, not flipping fidget spinners.

Step Two: Demand Validation (Without Fooling Ourselves)

Revenue screenshots are seductive. But revenue alone is a trap.

We look deeper:

- Search volume trends

- Sales velocity across multiple competitors

- Number of reviews vs. revenue (to estimate market age)

- Keyword depth (are there multiple buying-intent keywords?)

If one product dominates 80% of sales and everyone else scraps for crumbs, that’s not a healthy opportunity. That’s a monopoly waiting to crush new entrants.

Healthy markets have distributed revenue. Multiple sellers making good money. Not one king and 50 peasants.

We’re looking for oxygen, not scraps.

Step Three: Competition Isn’t the Enemy. Bad Competition Is.

“Low competition” sounds attractive until you realize it often means “low demand.”

We don’t avoid competition. We measure it.

Here’s what matters:

- Review count velocity (how fast competitors gain reviews)

- Listing quality (are photos, copy, and branding weak?)

- Brand presence (are competitors generic sellers or real brands?)

- Price stability (is there a race to the bottom happening?)

If listings look like they were designed in 2007 with blurry images and bullet points that read like machine translation, that’s opportunity.

Data tells us where the weak spots are. Branding exploits them.

Step Four: Margin Modeling Before We Fall in Love

Emotion is expensive in ecommerce.

Before we even consider sourcing, we build a financial model.

We estimate:

- Manufacturing cost

- Shipping (air vs. sea)

- Duties and customs

- Amazon or marketplace fees

- PPC (advertising) assumptions

- Return rate projections

Then we test worst-case scenarios.

What happens if PPC costs 30% more than expected?

What if price drops by $3?

What if conversion rate underperforms?

If the product collapses under slight pressure, it was never strong.

Private label decisions should survive stress tests. If the numbers only work in perfect conditions, that’s not a business model. That’s wishful thinking with spreadsheets.

Step Five: Differentiation Must Be Quantifiable

“Let’s make it better” is not a strategy.

Better how?

Longer warranty?

Improved packaging?

Bundle addition?

Feature enhancement?

Visual branding upgrade?

We use competitor reviews as raw intelligence. Negative reviews are gold mines. They show us exactly where customers feel friction.

If 400 people complain about a zipper breaking, that’s not random noise. That’s an opportunity.

Data shows us what to fix. Branding communicates that we fixed it.

Step Six: Keyword Mapping Shapes the Product Itself

This is where many sellers miss something subtle.

Keywords don’t just shape listings. They shape product decisions.

If customers frequently search:

- “travel size”

- “eco-friendly”

- “for sensitive skin”

- “extra large”

- “with lid”

That’s market intelligence.

Search behavior reflects intent. Intent reflects unmet needs.

Instead of forcing a generic product into the market, we reverse-engineer from search demand. We build around what people are already trying to buy.

That’s not manipulation. That’s alignment.

Step Seven: Platform-Specific Data Changes Everything

Amazon, eBay, and Etsy behave differently.

On Amazon, algorithmic ranking heavily rewards conversion rate and velocity. On eBay, listing structure and competitive pricing dynamics matter differently. On Etsy, brand story and aesthetic presentation influence discoverability and buyer trust in unique ways.

So our data analysis adapts.

Amazon decisions are conversion and search-volume heavy.

eBay decisions lean into pricing gaps and catalog inefficiencies.

Etsy decisions focus on branding differentiation and visual positioning.

One-size-fits-all analysis is lazy. Platforms have personalities. Data reflects that.

Step Eight: We Model Lifecycle, Not Just Launch

Many sellers analyze launch potential but ignore product lifespan.

We ask:

- Is this product defensible?

- Can we expand variations?

- Can it become a brand category?

- Is it copycat-prone?

If competitors can duplicate it in 30 days with no barrier, margins will compress quickly.

We prefer products with:

- Branding depth

- Expansion pathways

- Repeat purchase potential

- Bundle opportunities

Data doesn’t just help us launch. It helps us scale and defend.

Step Nine: We Respect Uncertainty

Data reduces risk. It does not eliminate it.

No model predicts:

- Sudden supply chain shocks

- Platform policy changes

- Viral competitors

- Economic downturns

So we never treat data as prophecy. It’s a probability amplifier.

The smartest private label strategy is built on informed optimism — not blind confidence.

That distinction matters.

Step Ten: Continuous Feedback Loops

The real power of data begins after launch.

We track:

- Conversion rate shifts

- Organic keyword movement

- Ad performance

- Review sentiment

- Return reasons

Then we adjust.

Private label isn’t a single decision. It’s iterative refinement.

Data tells us when to:

- Increase ad spend

- Improve images

- Adjust pricing

- Introduce a variation

- Bundle strategically

Every datapoint is feedback from the market. And the market is the ultimate judge.

Why This Matters for Clients

Anyone can “find products.”

But sustainable ecommerce growth requires disciplined decision-making.

When decisions are guided by data:

- Capital is allocated intelligently

- Risk is calculated, not guessed

- Branding becomes strategic

- Scaling becomes systematic

Without data, you’re reacting.

With data, you’re engineering.

And engineering beats improvisation when money is on the line.

The Bigger Picture

Private label success isn’t about luck. It’s about stacking small, rational decisions that compound over time.

Each choice — market selection, pricing, differentiation, branding, keyword mapping — becomes a lever. Pull the right levers consistently, and growth becomes predictable.

Data is not exciting. It doesn’t feel heroic.

But it quietly prevents disasters.

It filters out ego.

It protects capital.

It reveals opportunity hiding in plain sight.

In ecommerce, discipline is underrated. But discipline wins.

And behind every “overnight success” private label brand, there’s usually a spreadsheet full of unglamorous, carefully analyzed decisions that made the outcome possible.

That’s not magic.

That’s method.

If you’re serious about building a private label brand backed by real data—not guesswork—our team at Eccommate can help. From product research and validation to branding, sourcing, and launch strategy, we handle the process end-to-end. Explore our full range of services and see how we turn data into profitable ecommerce brands on our main service page.

To better understand the broader evolution of private label strategies beyond just tools and tactics, it’s worth looking at industry research on how private labels have shifted from budget options to strategic value drivers in retail. Insights from global market analyses show that private labels are increasingly viewed as quality alternatives to national brands and are shaping consumer behavior across categories — a trend that underscores why data-backed decision-making matters more than ever in product selection and brand positioning. For a deeper look at these broader trends and the strategic importance of private labels in today’s market, you can explore this analysis on the new era of private label product content and consumer adoption on NIQ’s website.