(No hype. No guru math. Just reality.)

If you search this topic online, you’ll see two extremes.

One camp says you can start Amazon Private Label with $500 and “hustle your way up.”

The other camp says you needa capital of $20,000 minimum or you’ll fail instantly.

Both are… incomplete truths wearing confidence like a Halloween costume.

Let’s slow this down and talk like real humans who like money and dislike financial pain.

This blog breaks down what you actually need, why the numbers vary so much, and where new sellers usually miscalculate (badly). By the end, you’ll know where you land—and what kind of seller you’re realistically setting yourself up to be.

First: What “Amazon Private Label” Really Means (Financially)

Private Label isn’t just “selling on Amazon.”

It means:

- You own the brand

- You pay upfront for inventory

- You control packaging, listings, and pricing

- Amazon pays you later, not immediately

That last part matters more than people admit.

This is not dropshipping. Cash flow matters. Timing matters. Mistakes cost real money.

Think of Amazon Private Label as a small consumer brand, not an online side hustle.

The Big Myth: “You Can Start With Almost Nothing”

Technically? Yes.

Practically? That’s how people fund Amazon’s mistake museum.

Starting with too little capital doesn’t make you clever. It makes you fragile.

When your budget is razor-thin:

- One supplier delay hurts

- One bad PPC week hurts

- One inventory mistake kills momentum

Private Label rewards buffer, not bravery.

The Core Cost Buckets (Where the Money Actually Goes)

Let’s break this down without fluff.

1. Product & Inventory (The Big One)

This is where most of your capital goes—and should go.

Typical first order:

- 300–1,000 units

- $3–$8 per unit landed cost (product + shipping)

That’s $1,500 to $6,000 just to exist.

And no, ordering 100 units doesn’t “test the market.”

It tests Amazon’s patience and your nerves.

Why inventory matters:

- Amazon favors consistency

- Stockouts kill ranking

- Reorders take time (especially overseas)

If inventory eats most of your budget, that’s normal. If it doesn’t, you’re probably under-ordering.

2. Branding & Packaging (The Silent Multiplier)

This is where sellers either win quietly or lose loudly.

Budget range:

- Logo & brand identity: $150–$600

- Packaging design: $200–$500

- Inserts, barcodes, labeling: $50–$150

So roughly $400–$1,200.

Can you do it cheaper? Sure.

Will it cost you later in conversions and reviews? Also sure.

On Amazon, customers don’t read first. They judge. Branding does the talking before the bullet points ever load.

3. Amazon Fees (Non-Negotiable)

Amazon is not your partner. It’s a landlord with rules.

Expect:

- Referral fees: ~15%

- FBA fees: varies by size/weight

- Storage fees: small at first, painful later

For budgeting purposes, assume 30–35% of your sale price disappears into Amazon’s ecosystem.

Ignore this, and your profit math becomes a fantasy novel.

4. Product Photography & Listing Assets

Your listing is your salesperson. A bad one works against you.

Budget:

- Product photography: $150–$400

- Infographics & image design: $100–$300

- A+ Content (optional early): $0–$300

Call it $300–$800.

Yes, phones have good cameras now.

No, that doesn’t mean DIY photos convert.

5. PPC & Launch Budget (The “Breathing” Money)

Amazon doesn’t magically rank new products anymore.

You need:

- PPC testing

- Keyword data

- Initial velocity

Minimum realistic PPC budget:

- $300–$800 for the first 30 days

This is not “wasted money.” It’s market tuition.

People who skip PPC don’t save money—they delay failure.

6. Software, Tools & Operations

This is smaller, but unavoidable.

- Product research tools

- Keyword tracking

- Basic accounting

- Amazon seller account

Expect $100–$200/month early on.

Not glamorous. Still necessary.

So… What’s the Real Starting Capital?

Let’s put it together.

Bare-Minimum (High Risk, Low Margin)

$2,500–$3,000

- Very small inventory

- Little PPC room

- No margin for error

This is survival mode. Not recommended unless you enjoy stress.

Realistic Starter Budget (Recommended)

$4,000–$6,000

- Proper inventory

- Clean branding

- Enough PPC to learn

- Room to fix mistakes

This is where most successful first products live.

Comfortable, Strategic Start

$7,000–$10,000

- Strong inventory position

- Aggressive testing

- Faster scaling potential

- Lower emotional damage

This doesn’t guarantee success—but it dramatically improves your odds.

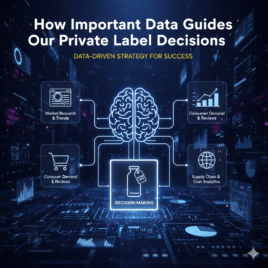

Why Most People Still Fail (Even With Money)

Capital alone doesn’t save bad decisions.

Common killers:

- Chasing saturated products

- Ignoring differentiation

- Cheap branding

- No long-term plan

- Panic pricing

- Random PPC strategies

Money amplifies competence.

It also amplifies incompetence.

That’s why guidance, systems, and experience matter just as much as budget.

A Quick Reality Check (Read This Twice)

Amazon Private Label is not:

- Passive income

- A weekend project

- A guaranteed ROI machine

It is:

- A real business

- Front-loaded with costs

- Back-loaded with profit

- Scalable if done correctly

If that excites you, you’re in the right place.

The Smart Question Isn’t “How Little Can I Start With?”

It’s:

“How much runway do I need to learn without crashing?”

That answer is different for everyone—but pretending you can skip costs doesn’t make you clever. It makes you temporary.

The sellers who last aren’t the ones who started cheapest.

They’re the ones who planned like adults and built like brands.

Starting Amazon Private Label is less about shortcuts and more about doing the fundamentals right—product selection, branding, listings, and execution. If you’d rather avoid costly trial-and-error and want a team that’s already built and scaled private label brands, explore our Amazon Private Label Services to see how we help sellers launch smarter, faster, and with a long-term growth plan in place.

Amazon itself is transparent about how selling on its platform works, including fulfilment fees, referral fees, and seller responsibilities. For anyone serious about starting a private label business, it’s worth reviewing the official Amazon seller resources to understand how the marketplace operates from Amazon’s side, not just from third-party advice. Knowing these fundamentals early helps set realistic expectations around costs, margins, and cash flow before investing capital.