First, let’s define “profit” in Amazon Private Label (because this is where the internet cheats)

When most people say “I’m profitable,” they mean one of three things:

• Their product is selling

• Amazon deposited money into their bank

• Revenue > product cost

That’s not profit. That’s hope wearing a spreadsheet.

Real profit means:

You’ve paid for inventory, shipping, Amazon fees, PPC ads, returns, refunds, software tools, and still have money left that you could actually withdraw without hurting the business.

If that definition already made you uncomfortable — good. You’re ahead of 80% of sellers.

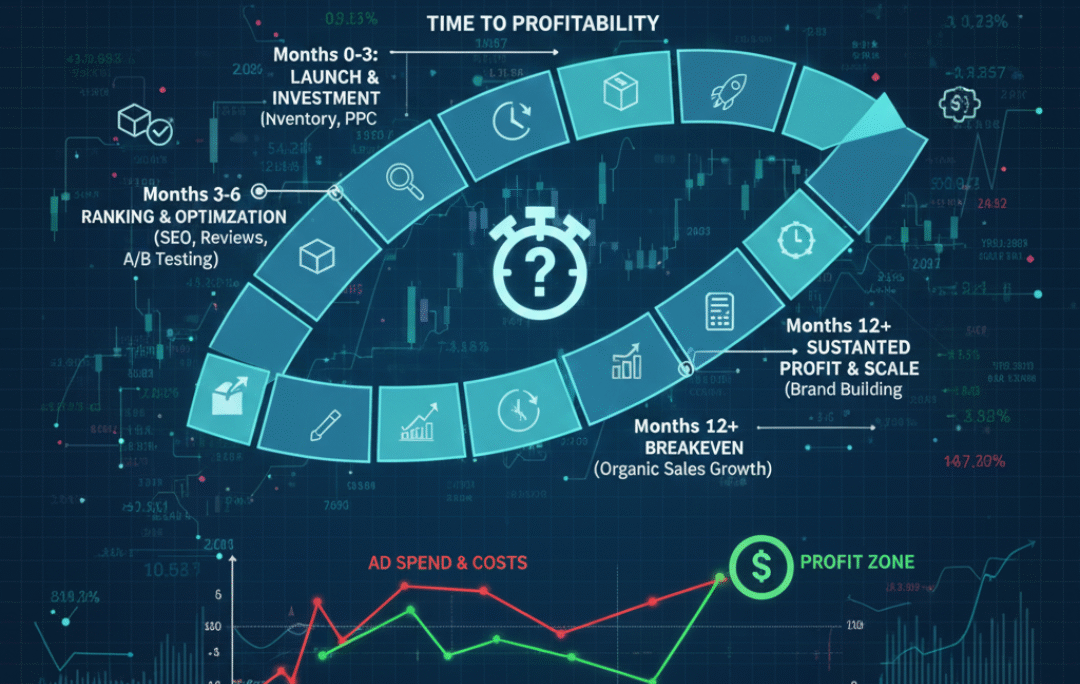

The realistic Amazon Private Label timeline (no fairy dust)

Let’s walk through this the way it actually happens for most serious sellers.

Months 0–1: Research, setup, and spending money with no dopamine

This is the “why am I doing this” phase.

You’re:

• Researching products

• Analyzing competitors

• Talking to suppliers

• Designing branding and packaging

• Setting up Seller Central

• Paying for samples

There is zero revenue here.

Only expenses.

This is normal. This is necessary. This is where impatient people quit.

If someone tells you they made money in this phase, they’re lying or selling a course.

Months 2–3: Production, shipping, and existential dread

Now you’ve committed.

You’ve placed inventory orders.

You’ve wired money overseas.

You refresh WhatsApp waiting for supplier updates.

You learn the phrase “shipping delays” emotionally.

Still no sales.

Still no revenue.

Still spending.

This phase separates builders from gamblers.

Amazon Private Label is capital-intensive early — anyone pretending otherwise is being dishonest.

Month 4: Launch month (aka “it’s alive but fragile”)

Inventory finally lands.

Your listing goes live.

You turn on PPC.

Sales start trickling in.

This is usually when people feel relief, not profit.

Why?

Because:

• Ads are expensive early

• Reviews are limited

• Conversion rate isn’t optimized yet

• Ranking is unstable

Most sellers lose money or break even this month.

That’s not failure. That’s launch physics.

Month 5–6: The break-even zone (where discipline matters)

This is the most important phase.

You now have:

• Some reviews

• Some keyword data

• Real ad performance metrics

• A sense of demand

Smart sellers start adjusting:

• Killing bad keywords

• Improving listing copy

• Fixing images

• Tweaking pricing

Dumb sellers:

• Panic

• Slash prices

• Turn ads off randomly

• Blame Amazon

By the end of this phase, many sellers break even or see small profit.

This is the first moment you can say, “Okay… this might actually work.”

Month 7–9: Where profit should appear (if fundamentals are right)

If:

• Your product was properly researched

• Your branding isn’t generic

• Your listing converts

• Your PPC is under control

This is when Amazon Private Label usually turns meaningfully profitable.

Not “quit your job” money yet.

But real, repeatable margin.

This is also when:

• Reorders start

• Stock planning matters

• Cash flow becomes a skill

Profit here is often reinvested — because scaling is the real goal, not flexing screenshots.

Month 10–12: Stability, scaling, or exposure of mistakes

By the one-year mark, the truth is unavoidable.

Either:

• You have a stable, profitable product

• Or the flaws are undeniable

At this stage, successful sellers:

• Optimize supply chains

• Reduce ad dependency

• Increase margins

• Prepare product #2

Unsuccessful ones usually realize:

They skipped fundamentals, rushed decisions, or undercapitalized.

Amazon is brutally honest. It doesn’t reward vibes. It rewards systems.

So… what’s the average time to profit?

For a properly executed Amazon Private Label brand:

• Break-even: 4–6 months

• Consistent profit: 6–9 months

• Strong profitability: 9–12 months

Anyone promising faster is either:

• Exceptionally lucky

• Exceptionally dishonest

• Or ignoring real costs

Why most people think it takes longer than it should

Three reasons, and they’re painfully common.

1. Underestimating capital

Running out of cash kills more Amazon businesses than bad products.

Ads need fuel.

Inventory needs reordering.

Growth requires breathing room.

Starving a product doesn’t make it disciplined — it makes it weak.

2. Treating Private Label like a side hustle, not a business

Inconsistent attention = inconsistent results.

Private Label isn’t passive.

It becomes passive after systems are built.

Until then, it demands decision-making, analysis, and patience.

3. Generic branding

If your product looks like everyone else’s, Amazon turns into a price war.

Strong branding:

• Improves conversion rate

• Lowers ad costs

• Builds customer trust

This is why serious sellers invest early in design, messaging, and positioning.

Can it be faster? Yes. Should you expect that? No.

Experienced sellers with:

• Capital

• Data

• Proven suppliers

• Existing infrastructure

Can sometimes hit profit in 3–4 months.

Beginners chasing that timeline usually rush, cut corners, and burn money.

Speed is earned, not promised.

The real mindset shift that makes Amazon work

Amazon Private Label is not:

“Launch product → get rich → relax”

It’s:

“Build asset → optimize → scale → compound”

When sellers stop chasing quick wins and start building brands, timelines feel less frustrating — because every month adds value, not just revenue.

Final truth (no sugarcoating)

If you’re asking how long it takes to see profit, you’re already thinking more clearly than most.

Amazon Private Label rewards:

• Patience

• Planning

• Capital discipline

• Branding

• Data-driven decisions

It punishes:

• Impulse

• Copy-paste strategies

• Unrealistic expectations

Do it right, and profit usually follows in months — not weeks, not years.

And once it clicks, it scales in a way very few online businesses can match.

If you’re serious about building an Amazon Private Label brand—and want to avoid the expensive trial-and-error phase—our Amazon Private Label service is designed to handle the heavy lifting, from product research and branding to launch and scaling. You can explore how we work and what’s included by visiting our main service page and see if it aligns with your goals.