Amazon product hunting gets talked about like it’s a treasure hunt. Scroll some tools, spot a low-review product, order inventory, pray to the algorithm gods.

That fantasy is exactly why most sellers lose money.

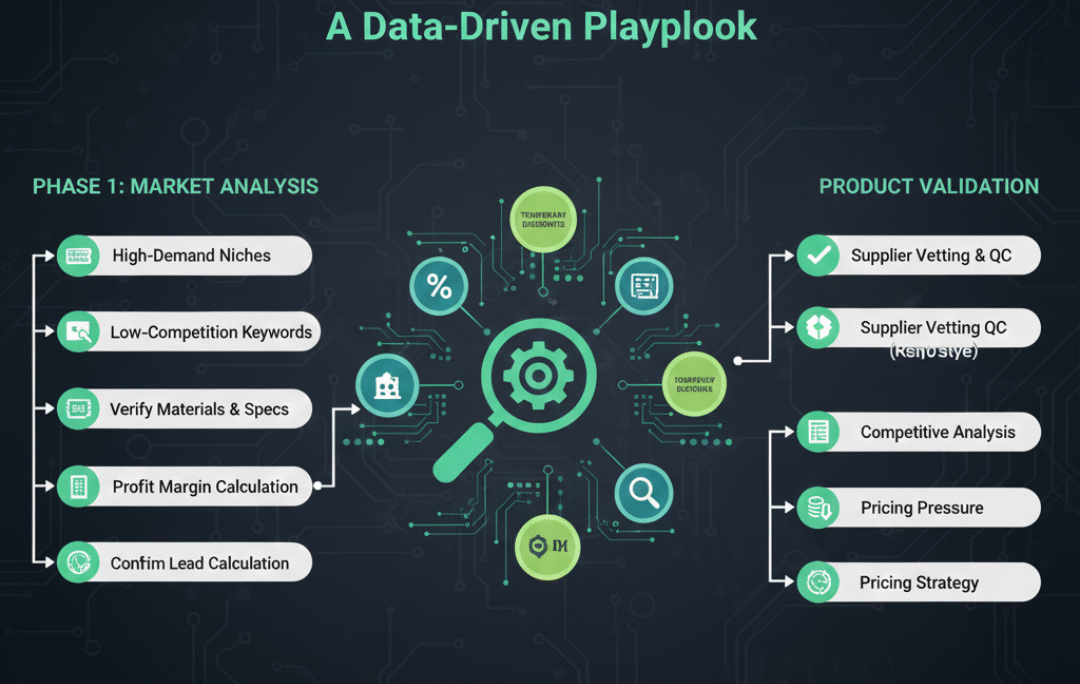

Ecom Mate don’t “hunt” products — they engineer outcomes. They treat product selection as a controlled experiment built on data, economics, psychology, and supply-chain reality. This article breaks down their exact process, why each step matters, and the original insights agencies learn the hard way — the things most generic guides never tell you.

This isn’t surface-level. This is the playbook for our Product Hunting Services.

Why Amazon Product Hunting Actually Matters (More Than Ads or Listings)

You can fix a bad listing.

You can optimize ads.

You cannot fix a fundamentally bad product choice.

A weak product has:

- A low fake demand (search volume without buyer intent),

- invisible competition (Strong brands masquerading as small numbers of reviews),

- or margins that collapse once advertising and returns are in effect.

“Product hunting” (Kotler, 2003, p.135): The act where profits can be

Step 1: Demand & Trend Intelligence (Finding Real Buyer Intent)

Ecom Mate start off broad for product hunting, researching thousands of prospective ideas with the use of Helium 10, Jungle Scout, Keepa, and other dashboards. But the key difference is how they interpret demand.

They don’t chase spikes.

They chase stable curves.

What they actually look for

- Keywords with consistent monthly searches over 12–24 months

- BSR histories that move smoothly, not violently

- Categories where demand grows gradually, not explosively

A sudden spike often means:

- a TikTok trend,

- a seasonal gimmick,

- or a competitor manipulating volume.

Agencies prefer boring graphs. Boring graphs make money.

Step 2: Hard Filters (Killing 90% of Ideas Early)

Once demand exists, Ecom Mate aggressively eliminate ideas.

Typical internal filters look like:

- Price sweet spot: $20–$60

- Monthly sales floor: 300–1,000 units

- Average top-page reviews: below 2,000

- Net margin after ads & fees: 30–40% minimum

- No heavy gating or IP landmines

This step is ruthless by design. Emotion never survives the spreadsheet.

Step 3: Competitor Analysis That Goes Beyond Review Counts

This is where amateurs stop and agencies begin.

Ecom Mate don’t ask:

“How many reviews do competitors have?”

They ask:

“How strong are these competitors really?”

What they analyze

- Review velocity: 2,000 reviews over 5 years is weak; 300 reviews in 3 months is dangerous.

- Brand cohesion: Does the seller own the niche or just sell a SKU?

- BSR stability: Wild rank swings = unstable demand or heavy ad dependency.

Original Insight #1: Review Velocity > Review Count

A product with fewer reviews but fast recent growth is harder to beat than an older listing with thousands of stale reviews. Momentum beats legacy.

Step 4: Review Mining (Where Products Are Born)

Ecom Mate read reviews like anthropologists.

Not the stars — the complaints.

They categorize:

- quality failures,

- usability friction,

- packaging problems,

- unmet expectations.

Patterns matter more than individual comments.

Example

If 12% of reviews complain that a handle gets hot, that’s not noise — that’s a product opportunity.

Original Insight #2: Single-Feature Domination

You don’t need 10 improvements. One dominant fix customers care about can win a niche. “Doesn’t melt at 400°F” beats “now with 3 extra colors.”

Step 5: Keyword & SEO Reality Check

Ecom Mate map keywords before committing to the product.

They validate:

- Can this product rank for transactional keywords?

- Are competitors ranking due to relevance or brute-force ads?

- Are long-tail keywords underserved?

Original Insight #3: Packaging Impacts SEO

Better packaging → better images → higher CTR → better conversion → better ranking. Amazon SEO isn’t just keywords; it’s behavioral math.

Step 6: Profit Modeling (Where Dreams Go to Die)

This is the most misunderstood step.

Ecom Mate assume:

- high PPC costs at launch,

- return rates,

- defects,

- and delayed cash flow.

Sample conservative math

- Selling price: $34.99

- Manufacturing: $7.50

- Shipping: $1.50

- Amazon fees: $6.50

- PPC (early): $4.00

Net profit ≈ $15.49 per unit (44% margin)

Original Insight #4: Shipping Windows Kill Margins

Air freight during Q4 can erase profits instantly. Ecom Mate model logistics timing, not just cost.

Step 7: Sourcing Isn’t Just Finding a Supplier

Ecom Mate don’t trust listings or chat promises.

They:

- request factory videos,

- inspect samples physically,

- verify materials,

- confirm lead times in writing.

Original Insight #5: Operational Risk Is a Profit Variable

A cheaper supplier with inconsistent QC is more expensive long-term than a higher-cost reliable one.

Step 8: Small-Batch Validation (The Anti-Gamble)

Before scaling, Ecom Mate test.

- Small inventory

- Limited PPC

- Measure conversion rate, CPC, return reasons

If conversion is weak, they fix the product — not the ads.

Composite Case Study: How Ecom Mate Actually Win

Their rivals boasted thousands of reviews with slow review speed.

A strong version with proof-based images was also launched.

Small batch validated conversion.

Added to inventory after numbers were proven viable.

No speculation. No hype. Just strategic implementation.

Final Takeaway: Ecom Mate Don’t Chase Products — They Design Them

Amazon product hunting at scale is not intuition. It’s systems.

Ecom Mate win because they:

- eliminate emotion early,

- validate before scaling,

- treat logistics and reviews as strategy,

- and understand that a product is a business decision, not a guess.

Once you internalize that, product hunting stops feeling mysterious — and starts feeling repeatable.